On-chain data demonstrates that Ethereum investor profitability has improved dramatically as a result of the asset’s recent price increase.

The profitability of Ethereum holders has just seen a dramatic reversal

Sentora (previously IntoTheBlock), an institutional DeFi solutions provider, has written a new post on X on how the profit-loss scenario on the Ethereum network has altered.

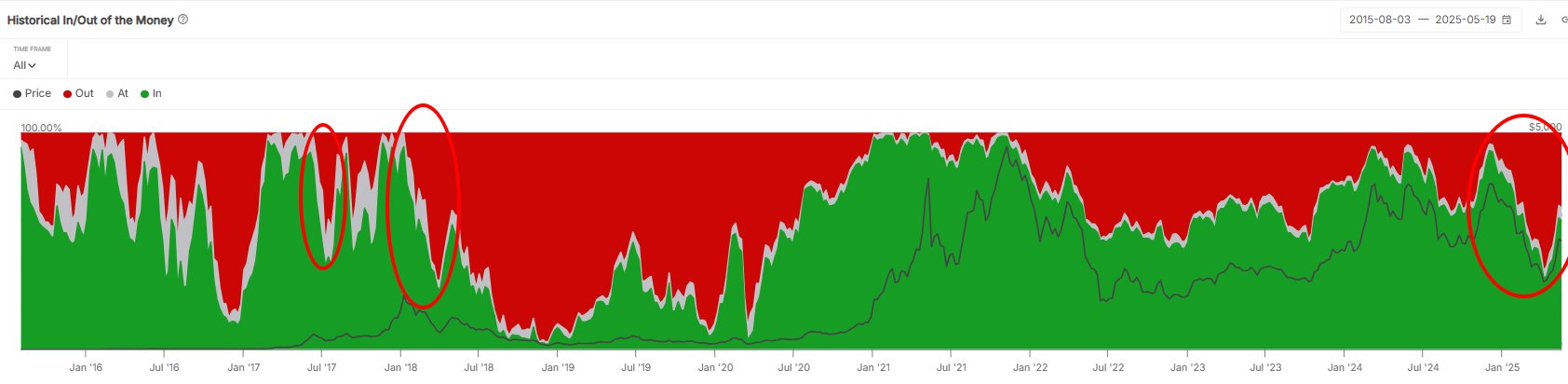

The “Historical In/Out of the Money” on-chain indicator is relevant here since it informs us how much of the ETH userbase is profiting (“in the money”), losing (“out of the money”), or simply breaking even (“at the money”).

The measure works by analyzing each address’s on-chain history to determine the average price at which it got its coins. If the average cost base is less than the spot price for any wallet, the user is regarded to be in the money. Similarly, the location is presumed to be unprofitable in the opposite situation and profitable when the two prices are equal.

Here’s a graphic showing the trend in Ethereum’s Historical In/Out of the Money over the last decade:

As shown in the graph above, in-the-money Ethereum investors experienced a significant decline during the selloff that began in December 2024. Prior to this drop, the statistic was above 90%, indicating that the great majority of customers had unrealized profits. By April 2025, however, the situation had drastically changed for the investors, with this value down to only 32%.

Another adjustment appears to have occurred for the cryptocurrency’s addresses, since the ETH price has recently risen sharply. Almost 60% of investors are now back in the money, which, although not quite at the level seen late last year, is much higher than the low.

The analytics firm’s graphic shows when Ethereum’s earnings previously fluctuated so dramatically. “The asset hasn’t witnessed volatility on this scale since the 2017 cycle,” Sentora said.

In other developments, ETH has recaptured two major on-chain levels following its rebound, according to Glassnode’s most recent weekly report.

The graphic shows that Ethereum recaptured the Realized Price early in the run. The Realized Price is the average cost basis for all investors on the Ethereum network. This milestone is currently around $1,900, which means that at the current exchange rate, the holders would be making a significant profit.

The cryptocurrency has now surpassed the True Market Mean, which is identical to the Realized Price but that it seeks to provide a more realistic average acquisition level for the market by removing long-lost inactive supply.

Ethereum now has one more level to reclaim: the Active Realized Price of $2,900, which is based on the Realized Price.

Ethereum has risen to $2,660, following a 4% surge over the previous week.

Our feature image was created by Microsoft Designer AI. All the rights of this image belong to them.