Bitcoin has gone above $111,000 to set a new all-time high (ATH) in the last week, as the crypto bull run continues. Although the flagship cryptocurrency has undergone some pullback since then, primarily due to the US government’s announcement of probable additional trade tariffs, investors remain optimistic, as a successful recapture of the previous ATH strongly implies the continuance of the current rise.

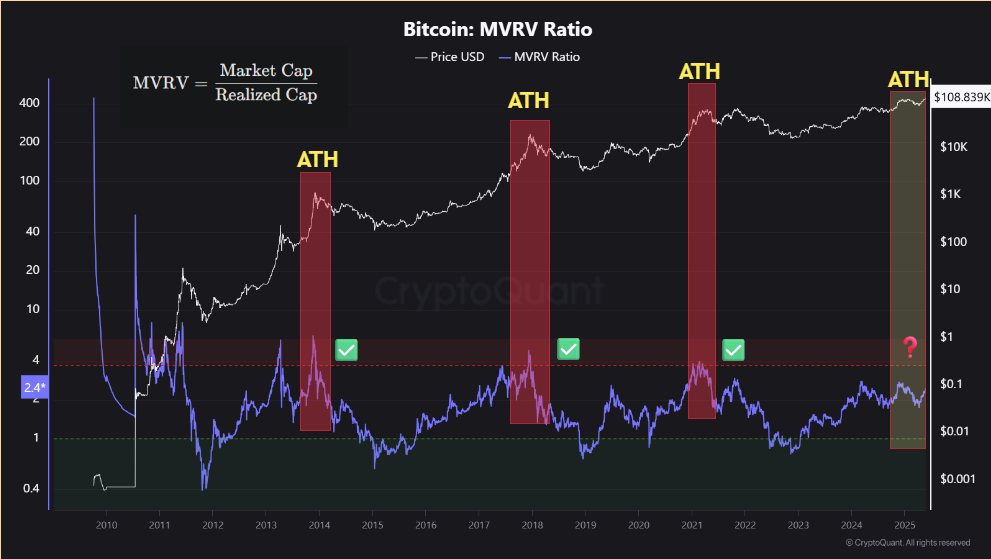

Interestingly, crypto expert BilalHuseynov has noticed an unusual trend with the Market Value To Realized Value ratio (MVRV), indicating a favorable difference between the present bull cycle and others.

Bitcoin MVRV Maintains 2.4 Despite New ATH – What Does This Mean?

In a QuickTake article on May 23, BilalHuseynov provides a unique perspective on the Bitcoin market in light of recent on-chain developments. Notably, on May 22, the primary cryptocurrency reached a new all-time high of $111,970, confirming the legitimacy of the current bull cycle.

Despite this bullish growth, BilalHuseynov observes an uncommon occurrence in which the MVRV ratio failed to achieve the peak figures linked with Bitcoin’s new all-time high in prior bull cycles. For reference, the MVRV compares Bitcoin’s market cap to its realized cap, or the worth of all Bitcoin at the last point of purchase. It is used to predict trend reversals, since an MVRV ratio more than 1 indicates overvaluation and a value less than 1 indicates undervaluation.

According to BilalHuseynov, when Bitcoin reached a new all-time high in the 2013, 2017, and 2021 bull cycles, the MVRV ratio peaked between 3.5 and 4.0. However, following the eclipse of $109,000, the MVRV ratio has reached a high of 2.4. The crypto expert argues that the lower MVRV statistic might be attributed to a disproportionate increase in Realized Cap relative to Market Cap. This trend may be linked to the fact that a large volume of circulating Bitcoin traded at higher prices, resulting in a larger cost base.

Surprisingly BilalHuseynov says that this unique phenomenon is a favorable indicator for Bitcoin’s long-term growth, showing a stable market even at ATH levels, with less froth and less hype-driven overvaluation. Furthermore, it is possible that stronger market hands, such as long-term holders and institutional holders, are among the new investors, implying long-term market confidence with no need for profit-taking.

The price of bitcoin Overview

Bitcoin is currently trading at $108,397, following a recent correction. The leading cryptocurrency is down 2.50% in the last day, but up 17.65% in the last month.

Our feature image was created by Microsoft Designer AI. All the rights of this image belong to them.