According to data, as Bitcoin and other assets have increased in value over the past day, there has been a large liquidation event among cryptocurrency short holders.

Bitcoin has surpassed $111,000 to reach a new all-time high

Bitcoin has defied predictions to not only rebound to the previous all-time high (ATH), but also to burst beyond it to achieve a new record over $111,800, despite the pessimism surrounding the cryptocurrency during the early stages of collapse.

The chart that follows illustrates the appearance of the asset’s most recent bullish push:

BTC appeared to be on the verge of reaching $103,000 earlier this month, but it couldn’t quite gather enough steam for that final push, resulting in sideways consolidation. However, this has changed in the last few days, with sustained momentum finally making an appearance.

Altcoins have lately had their own rallies, but in terms of weekly returns, the original digital asset has outperformed the majority of the leading ones. Ethereum, for example, has gained roughly 3.5% throughout this time, which is less than half of BTC’s 8.5% return.

Crypto Liquidations Exceeded $500 Million In The Last 24 Hours

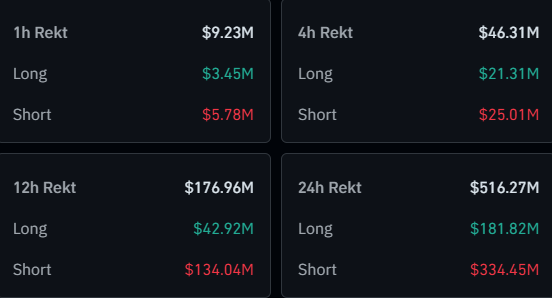

According to CoinGlass statistics, the volatility caused by the number one cryptocurrency resulted in the liquidation of a huge number of positions on derivatives exchanges during the last day. “Liquidation” refers to the forced closing of any open contract when its losses surpass a specified threshold (as set by the platform with which the position is open).

Here is a table that illustrates the important data on the most recent liquidations in the bitcoin market:

Bitcoin and Ethereum have been the top two contributors to the liquidations, as they always are.

A major liquidation event, such as the most recent one, is sometimes referred to as a “squeeze.” Given that the shorts were the worst struck in this incident, it would be referred to as a short squeeze.

While a significant number of liquidations have happened recently, it appears that speculators have not been dissuaded, as Bitcoin Open Interest has continued to rise.

The “Open Interest” metric tracks the total number of BTC-related positions that are presently open across all derivatives platforms. This indicator is currently at $81 billion, a significant rise from the $65 billion figure recorded on May 18th.

Our feature image was created by Microsoft Designer AI. All the rights of this image belong to them.