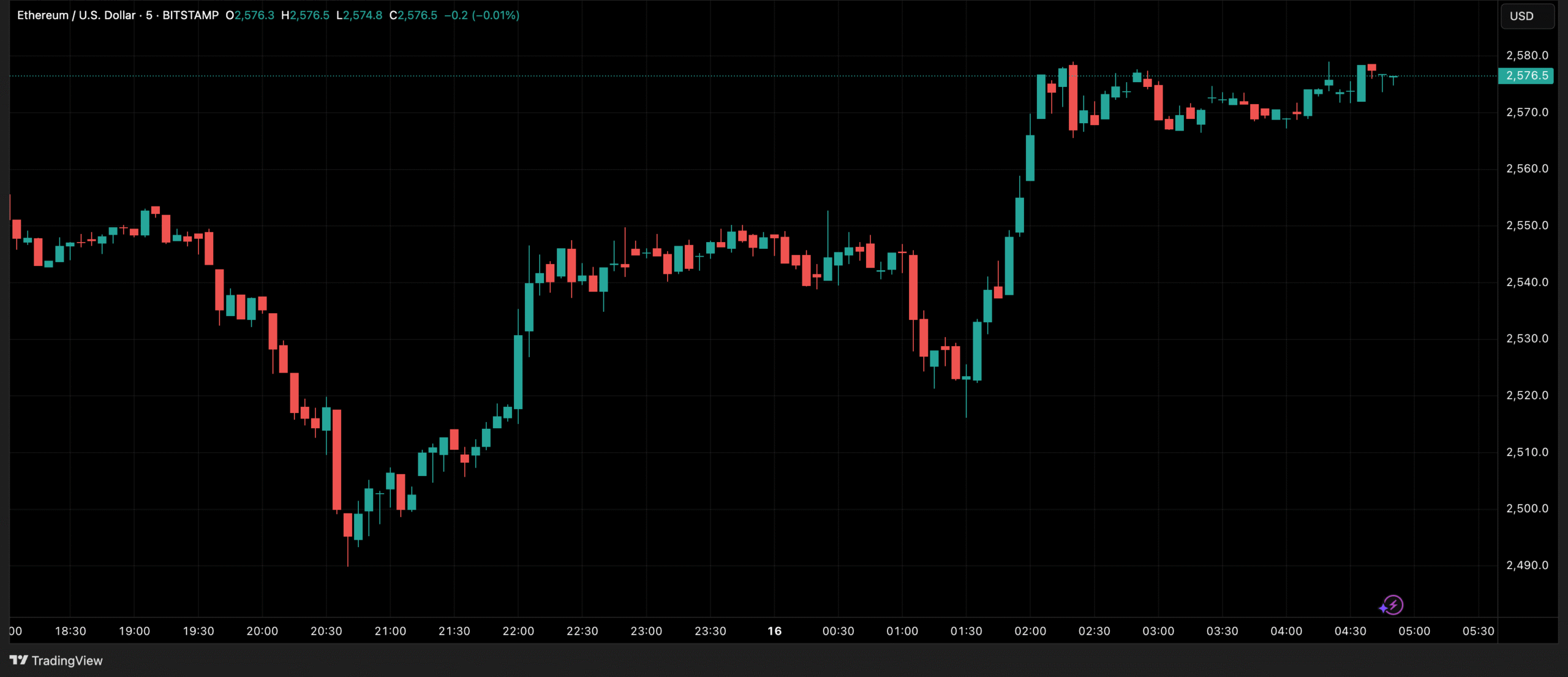

With Ethereum price currently hovering around $2,500, there is a lot of concern about the altcoin’s future. Most forecasts have gone into negative territory, with many forecasting that it will continue to decrease from here. However, others still believe that the second-largest cryptocurrency by market capitalization will exceed Bitcoin and reach the five-figure level this year.

Ethereum Price Set to Hit $10,000, According to Crypto Analyst

Despite the widespread adverse feeling around the Ethereum price, crypto expert Ash Crypto remains firm in their view that the cryptocurrency is still destined for big things. Taking on the X (previously Twitter) platform, the analyst made a daring $10,000 forecast, citing reasons why he believes Ethereum can achieve this goal by 2025.

A variety of reasons were offered for why the crypto expert expected the Ethereum price to increase fourfold from its present level, with adoption at the top of the list. Ash Crypto first discusses the considerable institutional buying that has occurred, and how this is a foreshadowing of what may be next.

The majority of the buying has taken place through ETFs like BlackRock, with big purchases occurring in recent weeks. During the time of the article, the analyst stated that these institutions had purchased $240 million in ETH in mere minutes, indicating that the buying trend was accelerating.

Furthermore, he emphasized that these institutions were not simply purchasing Ethereum for the sake of it. Instead, they were placing huge wagers on the altcoin’s future. The main bet is that the Securities and Exchange Commission will permit ETH staking for ETF issuers, which will have a significant impact on the price.

The crypto analyst lists a number of things that would happen if the SEC approved ETH staking for ETF producers, including the ability to earn a dividend on their investments. As staking gains traction, Ethereum will become the most popular cryptocurrency technology.

Next on the list is the fact that this would allow billions of dollars in real-world assets (RWAs) to be transferred on-chain to Ethereum, increasing usage and acceptance. The fee burn mechanism is projected to drive Ethereum’s deflationary supply, and as demand grows, so will the value of ETH.

Last but not least, staking permission would let institutions to generate passive revenue by staking ETH. This implies that, in addition to the expected rewards when the Ethereum price grows, they will earn additional money by staking the coins and keeping them locked up. “Smart money moves before retail,” the expert explained.

Our feature image was created by Microsoft Designer AI. All the rights of this image belong to them.