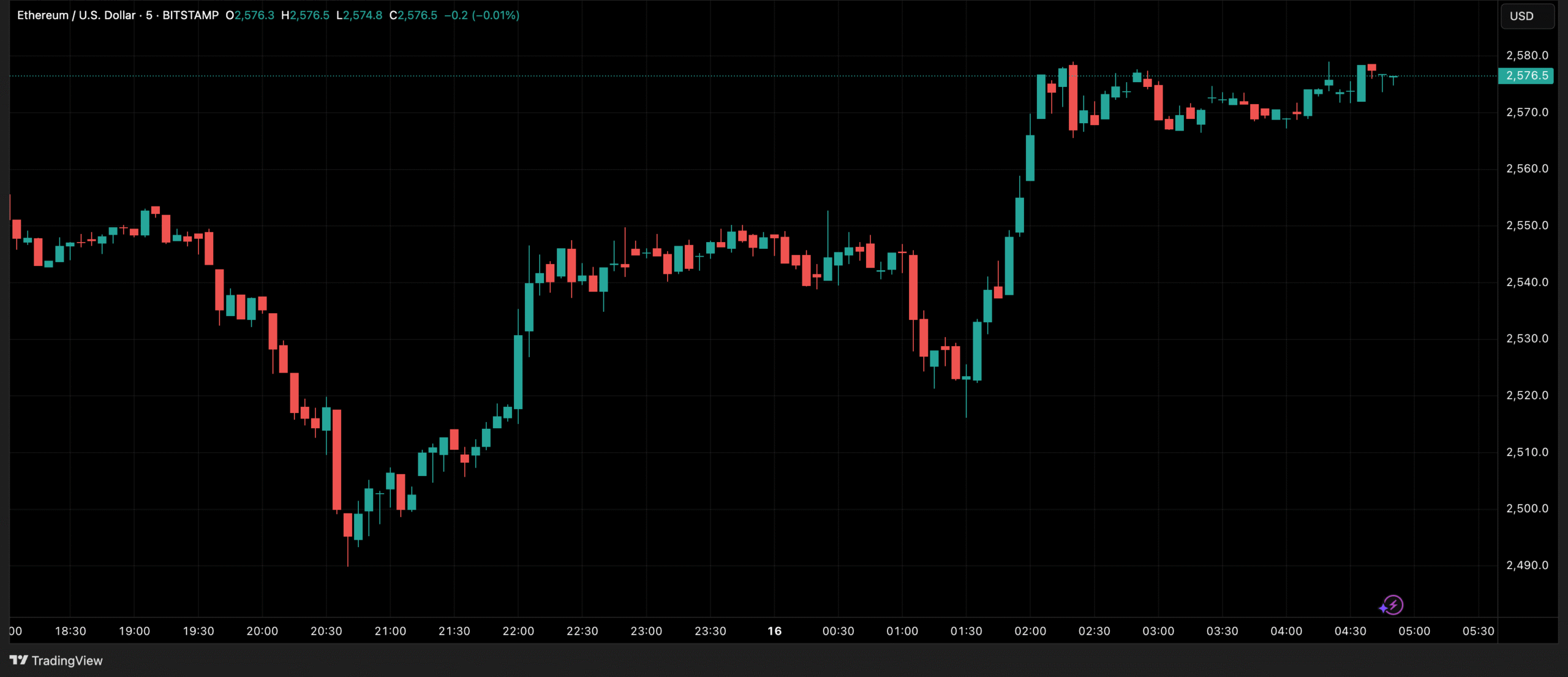

The Ethereum price made a quick and significant rebound at the start of the year’s second quarter, after struggling in the first few months of 2025. While the “king of altcoins” is substantially better off than it was a few months ago, ETH has not pleased in recent weeks.

The Ethereum price has been locked in a consolidation zone before dropping to a new swing low during the last week. In the late hours of Saturday, June 21, the altcoin’s value plunged below $2,300 in a single move, matching the market’s growing selling pressure as tensions in Asia escalate.

Is the price of ETH about to rise again to $1,200?

In a post on the X platform on June 21st, Chartered Market Technician (CMT) Aksel Kibar painted an interesting negative picture for the Ethereum price in the next weeks. According to the market analyst, the price of ETH may be about to fall significantly.

This negative forecast is based on the price movement of an ascending channel pattern on the Ethereum chart over a weekly timeframe. An ascending channel is a technical analysis pattern that is defined by two significant (upward-sloping) trendlines: the upper line connecting the swing highs and the lower line connecting the swing lows.

Typically, the ascending channel pattern indicates the continuation of an upward price trend. However, a breakthrough of this channel might indicate a trend reversal or continuance. For example, a breakthrough beneath the lower trendline indicates that an ascending trend may be shifting to a downtrend.

Furthermore, he emphasized that these institutions were not simply purchasing Ethereum for the sake of it. Instead, they were placing huge wagers on the altcoin’s future. The main bet is that the Securities and Exchange Commission will permit ETH staking for ETF issuers, which will have a significant impact on the price.

The crypto analyst lists a number of things that would happen if the SEC approved ETH staking for ETF producers, including the ability to earn a dividend on their investments. As staking gains traction, Ethereum will become the most popular cryptocurrency technology.

Next on the list is the fact that this would allow billions of dollars in real-world assets (RWAs) to be transferred on-chain to Ethereum, increasing usage and acceptance. The fee burn mechanism is projected to drive Ethereum’s deflationary supply, and as demand grows, so will the value of ETH.

Last but not least, staking permission would let institutions to generate passive revenue by staking ETH. This implies that, in addition to the expected rewards when the Ethereum price grows, they will earn additional money by staking the coins and keeping them locked up. “Smart money moves before retail,” the expert explained.

Our feature image was created by Microsoft Designer AI. All the rights of this image belong to them.